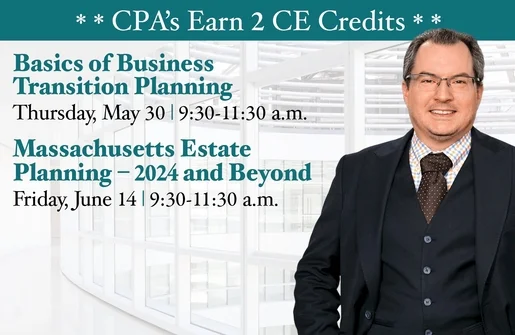

Join us for our upcoming webinar, “Basics of Business Transition Planning,” presented by Fletcher Tilton PC – Attorneys at Law‘s Michael Duffy. This informative session will be held both online and in person at our new office at 100 Front St on Friday, June 14th, from 9:30 AM to 11:30 AM.

In this webinar, Michael will discuss:

– Current state of Massachusetts trust and estate planning after 2023 increase in exemption limit;

– Potential strategies to reduce Massachusetts “Millionaire’s Tax” burden;

– Impact of potential reduction in federal exemption limit effective 1/1/2026;

– Overview of high-net worth planning strategies to reduce or eliminate federal and state estate tax burdens.

– In-person seminar (100 Front Street, 19th Floor Conference Center with coffee/danish).

Register now for either the webinar or in-person attendance: https://register.gotowebinar.com/register/7626932169789240665 (we will email you to confirm your preference).

#FletcherTilton #Webinar #TransitionPlanning #BusinessPlanning#EstatePlann