Massachusetts Paid Family and Medical Leave: Step One of a Step-By-Step Guide for Massachusetts Employers to Comply with This New Law

By Joseph T. Bartulis, Jr. on October 18, 2019INTRODUCTION

The purpose of this article is to notify employers what they need to do now to comply with the first aspects of the Massachusetts Paid Family and Medical Leave Act (PFML). Thanks to a recently implemented 3-month extension, the new law takes effect on October 1, 2019. Employers must follow the numbered steps below by September 30, 2019 to comply.

The Massachusetts Paid Family and Medical Leave Act (PFML) will be implemented on a rolling schedule, beginning on October 1, 2019, and taking full effect on January 1, 2021. For any work performed starting October 1, 2019, employers must deduct the required employee contributions from employee paychecks. These contributions will fund the new paid leave opportunities that will commence fifteen months later, on January 1, 2021.

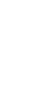

- There are two funds: 1. Paid Family Leave, and 2. Paid Medical Leave.

- Both will be funded by a total contribution of .75% of the first $132,900 of an employee’s annual wages. This .75% includes both the employee’s contributions and the employer’s contributions, if any.

- Paid family leave will be funded by .13% of payroll (or 17.5% of the total contribution).

- Employers are not required to contribute toward Paid Family Leave, so this may be funded 100% by the employee.

- Paid medical leave will be funded by .62% of payroll (or 82.5% of the total contribution).

- Employers with 25 or more employees are required to fund no less than 60% of the contribution for Paid Medical Leave. Employees may be required to pay the difference, up 40%, of the Paid Medical Leave contribution.

- For companies that have fewer than 25 employees, the employer is not required to contribute to either fund, so contributions to both funds may be entirely employee-paid.

- Regardless of the size of the employer, assuming the employer makes the minimum contribution, if any, an employee’s total contribution will be .378% of one percent of his or her earnings — .13% for Family Medical Leave and .248% (40% of .62%) for Paid Medical Leave.

The infographic below shows this same information in a flowchart format.

WHAT EMPLOYERS MUST DO BEFORE SEPTEMBER 30, 2019:

Post the Notice Prepared by the Massachusetts Department of Family and Medical Leave.

The first thing Massachusetts employers must do by September 30, 2019 is post the notice prepared by the Department of Family and Medical Leave (“Department”) in the common area(s) of the business where employee notice postings are presently posted. Any employer that has five or more workers whose primary language is other than English must also post the notice in the primary language of those five or more other individuals. The Commonwealth has generated the notice in multiple different languages for employers to use. It can also be found on the www.Mass.gov/DFML website or at this link: https://www.mass.gov/files/documents/2019/06/14/20190614_DFML%20Notice_English.pdf

The second thing Massachusetts employers must do is provide each employee with a notice apprising the employee of the law and any employer contributions or private plan exemption.

The Department has prepared a form entitled the “Rights and Obligations Under the Massachusetts Family and Medical Leave Act, M.G.L. c. 175M.” While employers may generate their own form, we recommend using the Department’s template. A copy of each of the Department’s applicable templates is attached to the end of this Article, and they can also be found on the www.Mass.gov/DFML website. As to when employees must employees must receive the notice:

- Current employees must receive this personal written notice no later than September 30, 2019.

- All new hires thereafter must receive this written notice within 30 days of starting employment.

Any business entity that uses Independent Contractors (as defined by MGL c. 149, section 148B) need only provide this notice to those Independent Contractors if Independent Contractors make up more than 50% of the business entity’s total workforce. The Department has prepared a template for businesses that fall into this category and it too is available on the Commonwealth’s website.

Guidance on Filling Out the Employer Notice to Employee Form

There are three areas on the personal notice to all employees that need to be filled out by the employer (the same form will be used for each of a company’s employees):

- First the employer must provide its name, address, and ID number.

- Second, employers must indicate how much of the contribution will be made by the employer for the Paid Medical Leave fund, and how much will be deducted from the employee’s paycheck. Unless the employer opts to pay more than its required share, the employer’s share will be 60%, and the employee’s share will be 40% assuming the company has 25 or more employees. For companies with fewer than 25 employees, the employer is not obligated to contribute at all, so the contribution may come only from the employee. Whereas an employee will never be obligated to pay more than 40% percent of the total Paid Medical Leave contribution regardless of the size of the employer, his or paying being required to pay 100% percent of the contribution simply means he or she will pay 100% of the 40% that can be assessed to the employee.

- Third, employers must enumerate how much of the contribution will be made by the employer towards the Family Medical Leave fund, and how much will be deducted from the employee’s earnings. Unless the employer opts to pay more than its required share, the employer’s share will be 0% and the employee’s share will be 100%

To assist employers, the Department has created a contribution calculator that will guide them regarding the contribution requirements. It can be found at: https://calculator.digital.mass.gov/pfml/contribution/

At the end of the form there is a place for each employee to acknowledge timely receipt of the form by signing it and returning it to the employer. Employers should keep detailed records of the date on which it provided the form to each employee and it should follow up with each employee to have him or her return the signed acknowledgment. If an employee, for whatever reason, is unwilling to sign and return the acknowledgement the employer may have the employee sign an alternative affirmation acknowledging receipt. If the employee also refuses to sign any alternative acknowledgment, the employer’s records should detail all relevant dates and times of any such refusal and a copy of that information should be retained by the employer.

Employers that fail to notify employees of the new law by a personal written notice before September 30, 2019 (in the case of current employees) and within thirty days of starting employment (for future employees), could be subject to a $50 penalty for each employee who was not timely notified. Thereafter the fine increases to $300 per employee for subsequent offenses pursued by the Commonwealth.

2. Begin Deducting the Required Contributions.

Once an employer has posted the notice of the new law, and has notified all employees in writing, the next thing all Massachusetts employers must do is adjust their payroll systems to begin deducting the required withholdings on all wages earned by all employees on October 1st and beyond. A business need not deduct any contributions from any payments it makes to Independent Contractors unless, as described above, more than 50% of the business’s workforce are Independent Contractors rather than employees.

The withholdings only apply to work performed on and after October 1, 2019.

The deductions need not be taken from wages paid after October 1 for work performed on or before September 30, 2019.

As with many other taxes and withholding retained by employers from employees’ paychecks, employers will be required to remit the employee withholdings and employer contributions, if any, quarterly. In the case of the PFML Act, the first applicable quarter ends on December 31st, 2019 and all withholdings tied to that quarter (Q4) must be paid via the Massachusetts Department of Revenue’s MassTax Connect system on or before the quarterly filing deadline established by the Department of Revenue which for Q4 of 2019 will be January 2020.

PRIVATE PLAN EXEMPTION

Under the PFML Act, there is one way that Massachusetts employers and their employees may avoid making any contributions to one, or both, of the new funds tied to Family and Medical leave. It is referred to as the “Private Plan Exemption.”

Employers that offer an employer-sponsored paid leave program that is equally or more generous than the PFML— in all aspects of either the employee medical leave and/or the family medical leave — may seek an exemption from the applicable contribution(s). Employers have until December 20, 2019 to apply for a private plan exemption to avoid making Q4 contributions into the funds. While the particulars of the Private Plan Exemption are beyond the scope of this Article and will be detailed in the next article in this series, I will nonetheless mention one key aspect now. Presently, most private plans consist of premium-based employer-sponsored short-term disability (STD) leave policies that only provide benefits to current employees. Since the PFML Act allows former employees to initiate access paid leave for a period after they have left an employer’s employ, virtually all current STD policies in place will not likely be found by the Department to provide an equally or greater benefit to the PFML — and will not be approved without modifications being made to them.

Any employer that offers disability and other employee paid leave protections should coordinate with their insurance provider (unless the plan is self-funded) to determine whether their plan meets the strict criteria under the PFLA and, if not, what changes may be needed. Any employer that believes its plan meets the exemption criteria should apply for the exemption as soon as possible but not later than December 20, 2019. If the exemption is approved the employer will not need to remit the Q4 contributions at the end of that quarter. Any employer seeking the Private Plan Exemption may apply for it at any time but will be responsible for remitting the contributions to the Department for the calendar quarter in which the exemption is applied for — with the sole exception of Q4 2019 — where the Department has allowed applications received by December 20, 2019 to be retroactive to October 1, 2019, if approved. For example, if an employer applies for an exemption on December 22nd and their plan is approved and exempted, that employer will still need to remit the contributions tied to calendar Q4 2019 because its application for an exemption for Q4 was not submitted by December 20, 2019.

CONCLUSION

This guide for Massachusetts employers is the first article in a series of articles planned for the next few months. Future will cover all other aspects of the new Massachusetts Paid Family and Medical Leave Act. The second article in the series will provide insight into the Private Plan Exemption. Any employer with questions about the described action items or any other aspect of PFML is welcome to contact me.